Can You Cash Out Bitcoin For Cash

It is essential for you to understand what you can do with your crypto assets. So, can you convert bitcoin to cash? Bitcoin has been around for more than a decade. When the crypto first started out, there weren’t many withdrawal options. Luckily, the industry has developed a lot. By now, there are several methods for cashing. The single best way to cash out large amounts of Bitcoin is through something called an OTC (over-the-counter) transaction. An OTC transaction occurs when a private buyer and private seller are linked together by an intermediary to facilitate the swap. You can’t withdraw your bitcoin into bank account directly. We can send your bitcoins withdrawn dollars into your bank account. Now a days bitcoin to bank account is suitable option for all the people who want to cash out bitcoin through exchanges. Unlike most cryptocurrency exchanges, you can cash out large amounts of Bitcoin on Coinsfera very easily. The Trading Desk team of our OTC (over-the-counter) exchange will help you to sell Bitcoin to cash within minutes. All you have to do is contact us via social media and reach our nearest office.

Bitcoins investment is one of the riskiest yet there are high profits included. ‘

Different Ways to Cash Out Bitcoins into Cash or Bank Account

The simple way to sell or cash out Bitcoins is to sell them via some websites which are quite famous and reliable in their business.

1. LocalBitcoins

On this website, you can sell Bitcoins in two ways- through online bank transaction or in hand transfer. You need to sign up and add the Bitcoins which you are willing to sell. You can prefer to sell for direct cash/ or bank transfer. People around you could see the price which you are quoting and can approach you. Since LocalBitcoins doesn’t verify the users beware of fraudsters as people you meet can harm you and may not be trustworthy. Localbitcoins connect the purchaser and seller personally where the Bitcoin can be converted to cash without any taxes or banking charges. Visit LocalBitcoins.

2. Bitquick

Bitquick is a platform where you can sell Bitcoins at the current price without any commission and is one of the fastest exchange. They provide a simple procedure where the user needs to enter the amount of Bitcoin on the personalized escrow address. There are various option to sell Bitcoin at such as static pricing and dynamic pricing. Dynamic pricing allows you to select the Bitcoin exchange rates and time of Bitcoin pricing. Such as 24hrs average, current price, whichever is greater. The amount would be directly sent to your bank from where you can withdraw the cash. Bitquick is not a secure website though, which may tamper your credentials. Visit Bitquick.

3. Coinbase

This is a trustworthy, safe place where you can sell Bitcoins for a reasonable price. Even though they levy a percentage of commission yet it is safe without any risks. You can go the wallet and select the number of Bitcoins you intend to sell. Once you confirm the amount would be sent to your bank which is being registered on Coinbase. Visit Coinbase.

4. CEX.io

Cex.io allows you to cash out the bitcoins in two different forms- bank transfer and cryptocurrency. This can be used for further investment or can be used to cash out. Cex.io is trustworthy exchange located in London. They require ID verification and valid proofs in order to make a transaction with them. Visit CEX.io.

5. Peer-to-Peer trading

This method of Bitcoin to cash includes a Bitcoin space such as Brawker or Purse where I would put my Amazon request regarding some household or personal purchase and the final cheque would be paid by a random stranger through his credit/debit card. Once the package reaches my place the Bitcoin space would pay the stranger in appropriate Bitcoins. In this way, the products which we need can be bought for Bitcoins. Bonus Tip:

How to Cash Out BTC in the Local Market

In most of the countries, people are waiting to buy and invest on Bitcoin without using a bank account. Some do that to save the tax amount while some do it for illegal purposes without producing any documents/credentials. In fact most of the people with black money these days prefer using Bitcoins for converting their black money, in countries like India, people end up paying 10-15% more than the actual Indian Bitcoin value just for a cash purchase. This method is both cheaper and riskier than other markets. If any of our friend, family or relative is holding a Bitcoin and are willing to sell then you can get the Bitcoin at the actual price i.e. 15-30% less than the Indian value. By that way, you can make an in hand transaction without paying any commission to Bitcoin exchanges or paying tax to the government. The liquidity of Bitcoin can be maintained by these way where you can save yourself from bearing a loss. Converting to hard cash is always slightly difficult and risky while you can convert it into the bank account or other cryptocurrencies easily. There are some websites such as Coin.ph where you can invest on Bitcoins and can take it back to the Coin.ph wallet where it is safe and secure. It can be reused to either invest or can be reverted back to the bank account.

Some people kill time at the airport by browsing duty-free shops. I decided to shop for bitcoin.

But first, there are two things you should know about me: I tend to be almost as afraid of losing money investing as I am of flying. On some level, I figured one fear might cancel out the other.

So last Thursday, while waiting for a flight to Nashville, I pulled up a popular application called Coinbase that can be used to buy and sell bitcoin. The virtual currency had hit $10,000 for the first time a couple days earlier, before retreating somewhat. News of bitcoin's rapid rise was everywhere, including on CNN.

For 15 minutes at the airport, I refreshed the price of bitcoin over and over, watching as it gained and lost hundreds of dollars in a matter of minutes. I called out the price fluctuations breathlessly to my wife, who gently encouraged me not to be an idiot, before returning to her magazine.

She was in good company. JPMorgan Chase CEO Jamie Dimon recently called bitcoin a 'fraud' and suggested people who buy it are 'stupid.' Warren Buffett called bitcoin a 'mirage' in 2014 and warned investors to 'stay away.'

Are you trading Bitcoin? We want to hear from you.

And yet bitcoin has climbed more than tenfold since Buffett's warning. Earlier this month, one college friend casually told me over drinks he'd made tens of thousands of dollars investing in another cryptocurrency. He said he hoped it would be worth enough one day to buy a house.

When I saw the price of bitcoin fall to $9,500, I pressed buy, defying the wisdom of two finance titans and my wife. One hundred dollars, or 0.0101 bitcoins. (A few days later, I bought another $150.) By the time we got to our hotel, my stake had already gone up 10%. One week later, it was (briefly) up 100%. My wife's opinion of me has reportedly decreased by the same amount.

What is happening?

It's an investing frenzy, plain and simple.

Bitcoin cracked $1,000 on the first day of 2017. By this week, it was up to $12,000, and then it really took off: The price topped $17,000 on some exchanges Thursday, and $18,000 on at least one.Other cryptocurrencies have seen similar spikes, though they trade for much less than bitcoin.

There's a long list of factors people may point to in an attempt to explain this. Regulators have taken a hands-off approach to bitcoin in certain markets. Dozens of new hedge funds have launched this year to trade cryptocurrencies like bitcoin. The Nasdaq and Chicago Mercantile Exchange plan to let investors trade bitcoin futures, which may attract more professional investors.

Yet a key reason the price of bitcoin keeps going up is, well, because it keeps going up. Small investors like yours truly have a fear of missing out on a chance to get rich quick. And when the value of your bitcoin doubles in a week, as it did for me, it's easy to think you're a genius. But you can get burned assuming it will keep skyrocketing.

Some investors have likened the bitcoin hype to the dot-com bubble. Others, like Dimon, have said it's even 'worse' than the Dutch tulip mania from the 1600s, considered one of the most famous bubbles ever.

As Buffettput it back in 2014, 'the idea that [bitcoin] has some huge intrinsic value is just a joke in my view.' Bitcoin is not backed by a company's earnings, or the strength of a government and rule of law. There's also no interest or dividends.

Why would anyone want or need to use bitcoin?

Bitcoin serves as a new kind of currency for the digital era. It works across international borders and doesn't need to be backed by banks or governments.

Or at least that was the promise when it was created in 2009. The surge and volatility of bitcoin this year may be great for those who invested early, but it undermines bitcoin's viability as a currency.

Right now, I can use my bitcoin holdings to pay for purchases at Overstock(OSTBP), or book a hotel on Expedia(EXPE). But if I use bitcoin to buy $25 worth of socks on Overstock today, and the price of bitcoin quadruples next week, I'll feel like those socks actually cost me $100. Then again, if bitcoin crashes, at least I'll always have the socks.

How To Cash Out Bitcoin For Cash

Rather than a currency, bitcoin is being treated more like an asset, with the hope of reaping great returns in the future.

So is there anything truly valuable about bitcoin?

Yes, the technology behind it.

Bitcoin is built on the blockchain, a public ledger containing all the transaction data from anyone who uses bitcoin. Transactions are added to 'blocks' or the links of code that make up the chain, and each transaction must be recorded on a block.

Even bitcoin critics like Dimon have said they support the use of blockchain technology for tracking payments.

Is there a legal and legitimate way to invest in bitcoin?

Bitcoin exchanges have a checkered history. Mt.Gox, once the largest exchange, shut down in 2014 after losing hundreds of millions of dollars worth of bitcoin after a hack.

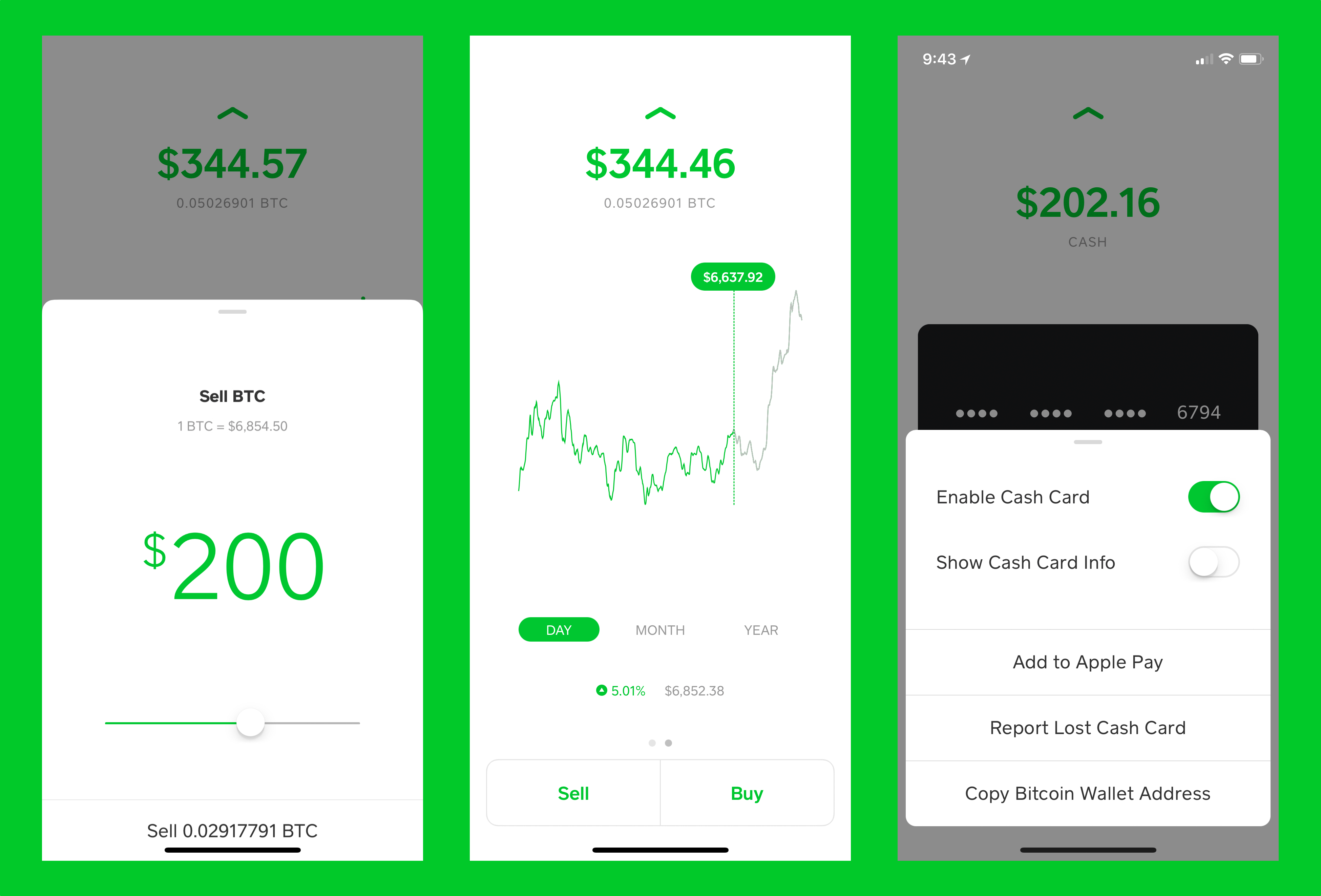

Today, the leading exchange is offered by Coinbase, a startup that has raised more than $200 million from a number of top tier venture capital firms. Square(SQ), the payments service, is also rolling out a bitcoin product.

There are also bitcoin ATMs in scattered bodegas and convenience stores around the country, through companies like Coinsource. The ATMs let you exchange bitcoin for cash, or vice versa by scanning a QR code from the digital wallet application on your phone.

With Coinbase, you must first give the app permission to connect to your bank account. As with other stock trading applications, you pay a small fee for each transaction, buying and selling. But the transaction can take significantly longer.

My original $100 bitcoin purchase won't officially be completed on Coinbase until Friday, more than a week after the transaction. The price I bought it at remains the same, but I won't be able to sell at the earliest until Friday.

If the price plummets before then, I'm out of luck. No socks for me.

-- CNN's Selena Larson contributed to this report.